Risk is an inevitable — and unavoidable — part of business. It’s why risk factors are a standard part of any business plan and why any business worth its salt has a risk management strategy in place. Awareness, understanding and preparedness in the face of risk is critical for mitigating it as well as building long-term resilience. But there’s one risk many companies are blind to: climate risk.

Climate-related disasters can no longer be considered isolated or random events: they’re a symptom of our global ecological emergency and a threat to people, planet and business. There’s a lot at stake and companies that want to stay in business will need to prioritize efforts to assess and address their short- and long-term climate risks.

Climate change-related risks are forecasted to cost businesses billions within the next few years via supply chain disruptions, increased operational expenses, loss of capital, penalties and more. Companies will also have to grapple with the devastating impacts climate change has on workforce health and safety. The financial and human costs incurred due to the myriad impacts of the environmental crisis far outweigh any short-term benefits of long-standing practices.

What’s more, tackling climate risk is also increasingly critical for maintaining strong investor relations. Investors are now scrutinizing companies’ climate risk through a lens of corporate resilience, weighing how prepared they are in the face of coming climate-related challenges and opportunities.

Companies that take action now to identify and address these risks will benefit not only from lower costs, but stronger brand reputations and resilience in the long run.

Predicting the unpredictable

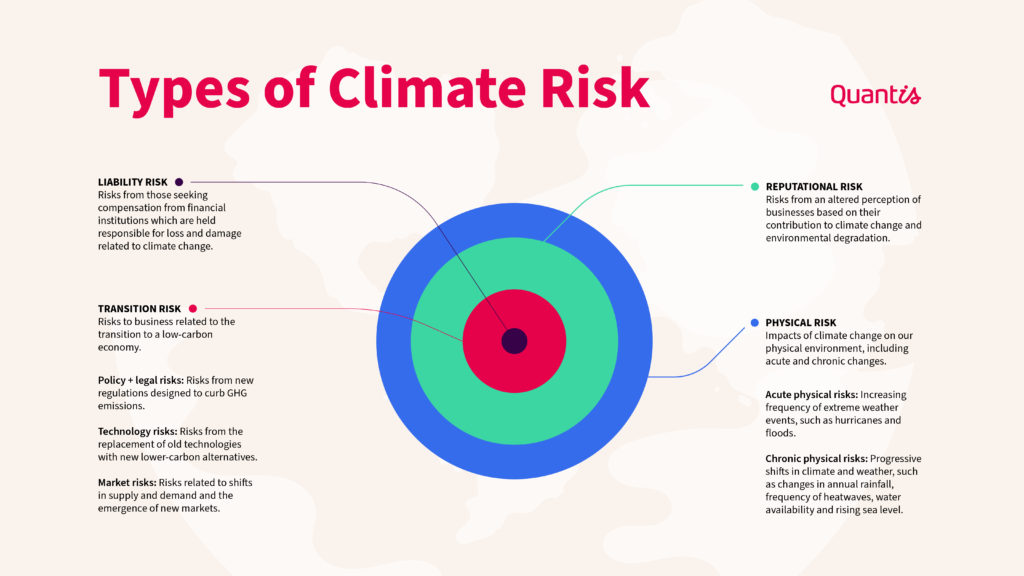

On the surface, climate risk seems relatively self-explanatory: a set of potential adverse outcomes or consequences to a business resulting from climate change-related impacts (drought, species loss and migration, wildfires) and, as such, it may be tempting to dismiss them as merely a driver of other traditional business risks. But to do so would neglect their scale and gravity. Urgent and fraught with uncertainty, climate change cannot — and will not — be ignored. There’s a clear business case to innumerate, address and mitigate the risks posed by climate change specifically.

Climate change is increasingly affecting businesses and compounding countless other risk factors as our environment shifts in unprecedented ways. To build resilience, businesses must brace for instability and work to mitigate the risks to physical and human capital in their global operations. This starts with identifying and understanding the level and nature of your climate risks. They will happen, but what, how and where depends specifically on your business.

Defining long- and short-term risks: The long and the short of it

Both near- and long-term impacts loom in the wake of climate instability. The short-term impacts require your immediate attention — they’ve already begun, and you’ve likely seen them manifest themselves already, be it in your supply chain, insurance claims, reporting or conversations with colleagues. Creating a realistic plan to address the mounting disruption and instability that climate change will undoubtedly cause is the best chance businesses have for navigating the short-term threats of climate change.

Long-term impacts offer a greater opportunity to identify and address underlying risk drivers. Taking action starting today will help mitigate these risks, and there’s still time to change the projection. A robust environmental sustainability program informed by climate-related risk assessment can help you determine where these impacts are likely to occur and how to protect your business from them.

According to the World Economic Forum’s Global Risks Report for 2022, environmental risks ranked among the top ten biggest threats to humanity in the short-, medium- and long-term categories. Respondents agreed that extreme weather, climate action failure and livelihood crises are immediate short-term threats already facing humanity.

In the next decade, all of the top ten greatest threats to humanity could be directly or indirectly connected to our climate crisis: climate action failure, extreme weather, biodiversity loss, natural resource crises, human environmental damage and more. These risks are considered imminent and noxious — and threats to humanity are inherently threats to business.

Climate risk: an entirely different animal (but with familiar characteristics)

Climate risks fall into familiar risk categories, but in a new context. Understanding how these risks may impact your company — and whether they offer opportunities to strengthen your company’s resilience — is paramount.

Investors, consumers and employees increasingly look for companies that have policies and procedures supporting climate action. So, while companies need to understand their climate risk, it is equally important that they recognize and capture the opportunities that come with addressing those risks and building climate resilience. Whether through resource efficiency, shifts toward alternative energy sources, switching to low-emission products or services, or investments in new markets, tapping into the opportunities embedded within climate risks demonstrates your company’s ability to grow and adapt to today’s changing environment. This is the agility investors are looking for as a key indicator of corporate resilience.

That said, consumers are increasingly aware of companies that claim to support environmental causes while perpetuating policies and practices that are environmentally damaging — often cited as greenwashing. Being open and authentic about your goals and efforts is the key to replacing risks with opportunities.

Considering the impact of unmitigated climate risk

Put bluntly: inaction is unacceptable — because the long-term impacts are unthinkable.

Economic models offer dismal predictions of the snowball effects of unchecked climate instability. If no action is taken and global temperatures rise by 3.2°C, the global economy could lose 18% of GDP by mid-century. Without proper climate risk mitigation, these impacts grow to monstrous proportions and infiltrate every aspect of society and business. And it could be worse. According to the World Bank, existing economic models are overly optimistic — the real impacts to commerce and human life may be far more dire.

Over the past several years, we have observed how geopolitical catastrophes can lead to shortages, price hikes and transportation network failures. These examples of supply chain volatility may foreshadow similar or even greater instability from the physical and transitional impacts of climate change. Without adequate climate risk mitigation and adaptation strategies, businesses leave themselves exposed to financial risk, brand damage, asset and operational damage and legal risk. As the supply of raw materials is limited or interrupted, costs rise for both businesses and the consumer. Furthermore, insurance premiums will increase as extreme weather patterns and worker shortages create unsafe and unpredictable circumstances.

Your workforce is a particular hotspot for climate risk: climate-related occupational hazards make both indoor and outdoor workers highly vulnerable, exacerbating existing health, safety and socioeconomic issues while opening the door to new hazards, both physical and psychological. The World Health Organization identifies several categories of workers who are especially at-risk: manufacturing workers, transportation workers, utility workers and farmers. Labor shortages in these fundamental industries would have widespread consequences, potentially leading to a cascade of detrimental impacts on human well-being and the economy as a whole.

Bottom line: If you intend to protect your business from the real and severe hazards posed by our changing climate, then you need to know where your business stands from a climate risk perspective and take immediate action to increase your resilience in the face of this crisis.

Six steps for risk assessment

There’s no time to waste. The following steps of our risk assessment process are aligned with the Task Force on Climate-Related Financial Disclosures (TCFD) framework. It’s offered here as guidance for businesses that are working to disclose climate-related risks and opportunities.

- Ensure governance is in place: Do this by integrating climate risk and scenario analysis into strategic planning and enterprise risk management processes. Assign oversight to the relevant board committee or subcommittees. Then, define which internal and external stakeholders to involve and how.

- Assess the materiality of climate-related risks: Get into the business of your business — where do you see current or potential exposure to climate-related risks and opportunities? Pay special attention to market technology shifts, reputational impacts, policy and legal issues, and physical risks, and consider whether your stakeholders are concerned. Then, rank the identified risks and opportunities as they apply to the sustained success of your company’s business model.

- Identify and define a broad range of climate scenarios: To evaluate corporate resilience across a diverse spectrum of possible futures, you’ll want to incorporate into your scenario analysis both physical and transition scenarios that sufficiently cover extreme temperature thresholds and divergent socioeconomic pathways. At least one of your scenarios should consider a future in which average global temperature rise is limited to 2˚C or, better yet, 1.5˚C. Develop the input parameters, assumptions and analytical choices that will confine and guide your scenario analysis. Consider using credible, publicly available scenarios such as the physical scenarios developed by the IPCC and the transition scenarios developed by the IEA or NGFS. Follow guidance provided by the TCFD, CDSB, CDP, and/or others to strengthen your scenario definition.

- Evaluate business impacts: What are the potential effects on your organization’s strategic and financial position based on each scenario? Be sure to weigh the impact on input costs, operating costs, revenues, supply chain, business interruption and timing. Quantifying the business impacts and defining their financial materiality will help you prioritize the identified risks and opportunities using corporate financials, proxy data and parameters of the defined scenarios.

- Pinpoint potential responses: Use these results to identify realistic decisions to manage the previously outlined risks and opportunities. Consider necessary adjustments. Potential responses might include changes to your business model or your portfolio mix, or investments in new capabilities and technologies.

- Document and disclose: Finally, document the process, communicate it to the relevant parties, and be prepared to disclose key inputs, assumptions, analytical methods, outputs and potential management responses.

Build corporate resilience through risk mitigation and adaptation

Once you’ve identified and assessed your company’s risk exposures from climate instability, you can begin building genuine climate resilience. Understanding your climate risk is the first step, opening the door for you to take action that will drive meaningful change.

Planning for and demonstrating climate resilience will look different for every company — there is no silver-bullet or one-size-fits-all solution. For companies with significant physical risk associated with the continuity and availability of agricultural commodities in the supply chain, this may mean engaging with suppliers, cooperatives, and governments to stabilize yields and prices despite turbulent weather conditions. For companies with significant transition risk associated with rapidly developing carbon pricing mechanisms, this could mean setting aggressive climate strategies that reduce greenhouse gas emissions across their operations. And for companies with significant transition risk associated with downstream markets that drive sales, this may mean developing business transformation plans that capture emerging low-carbon markets and managing reputational risks.

So what’s the best climate risk mitigation and adaptation strategy for your business? It’s the one you build based on a deep understanding of where your company’s most material climate risks lie within your value chain.

And while climate-related risk assessment and disclosure is vital, it’s what you do with that information to build resilience and unlock new opportunities that really matters.