In brief:

- The pharmaceutical sector relies heavily on nature: around 80% of medicines trace their origins to natural sources, and every stage of the value chain depends on stable ecosystems.

- That stability is under threat. Climate change, biodiversity loss and ecosystem decline are already disrupting supplies of essential medicines, exposing patients and companies to growing risks.

- Pharma’s own impacts – from water use to land conversion and pharmaceutical pollution – are adding to the pressures, driving both regulatory and financial risks.

- Despite progress on climate, nature risks remain under-addressed. Bridging the gap between high-level commitments and operational decisions in R&D, procurement and manufacturing is critical.

- Integration is the way forward: weaving nature into existing climate systems boosts efficiency, resilience and investor confidence while reducing duplication.

- Five priorities show where to start: protect the R&D pipeline, manage ecosystem risk in sourcing, build resilience at manufacturing sites, embed nature into finance, and lead on standards.

The pharmaceutical industry runs on stability. Reliable research conditions, steady access to raw materials, predictable logistics, and consistent manufacturing environments make it possible to innovate and deliver treatments patients depend on. That stability, however, is being disrupted by two escalating crises: climate change and biodiversity loss.

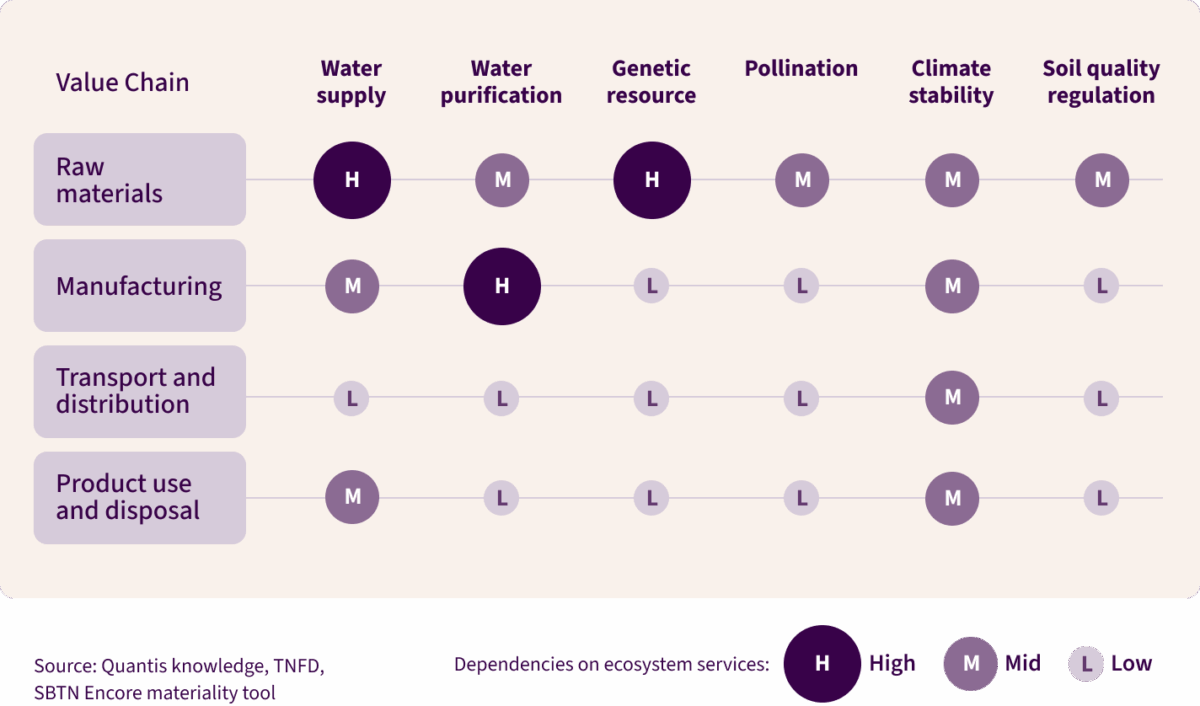

The following visual demonstrates just how dependent pharmaceutical companies are on nature:

Industries with high to moderate dependence on nature account for more than half of global GDP, and pharma sits firmly in that category. Progress on climate shows what’s possible when the industry takes integration seriously: carbon pricing, SBTi targets and net-zero roadmaps are now widely adopted. But while climate has reached operational maturity, nature risks remain under-addressed, leaving blind spots.

Nature is no longer a peripheral concern; its degradation is already reshaping how the sector operates.

Pharma’s growing exposure and footprint

Around 80% of medicines trace their origins to natural sources, and experts estimate that one promising medicinal compound is lost to extinction every two years. Some of the sector’s most important medicines – from ACE inhibitors for hypertension, first derived from Brazilian pit viper venom, to the cancer therapy Taxol, discovered in the bark of the Pacific yew tree, to trabectedin, developed from sea squirts – all trace back to ecosystems that had to be studied, protected, and in some cases conserved long enough for synthetic alternatives to be developed.

Meanwhile, critical inputs – from medicinal plants to maize and sugarcane – are increasingly vulnerable to drought, soil degradation and ecosystem decline. Manufacturing depends on large volumes of clean water, while logistics and cold chains rely on stable infrastructure and predictable conditions.

Every stage of the value chain is tied to nature’s stability – and that stability is faltering. When those systems fail, the consequences sit squarely on those who need it the most: patients. Artemisinin, derived from sweet wormwood, is the backbone of malaria treatment, yet climate-driven crop failures in Asia have already disrupted supply and pushed prices upward. Heparin, one of the most widely used anticoagulants, relies on pig intestines and has seen shortages linked to livestock disease outbreaks. And in India – a global hub for active pharmaceutical ingredients – floods and water stress have disrupted antibiotic production, leading to temporary shortages in global markets. Nature risk, in other words, translates directly into patient risk.

Exposure is only part of the story – pharma also contributes to the very pressures putting nature at risk. Water use, land conversion for feedstocks, and pharmaceutical pollution are among the sector’s most material impacts. That means pharma is not only vulnerable to physical risks like water scarcity, but also to transition risks as regulators respond.

The EU’s updated Urban Wastewater Treatment Directive, for example, is set to make pharmaceutical companies financially responsible for the cost of removing medicinal residues from wastewater – evidence that nature-related impacts are already translating into regulatory and cost exposure. Designing products with lower ecotoxicity can also reduce this burden, since upstream improvements may lessen contributions under the Extended Producer Responsibility (EPR) scheme.

Some leaders are beginning to act. For most, however, action still stops at the corporate level, far from where risks and opportunities truly materialize: in procurement, product development and operations. Bridging this gap between high-level commitments and everyday decisions remains one of the sector’s toughest hurdles.

Closing the gap: Operationalizing nature risks

Without an integrated approach, companies end up with a patchy picture that hides critical risks. The challenge is especially acute in pharma because of its complex, segmented supply chains. Risks look very different depending on the tier, the region and even the product line.

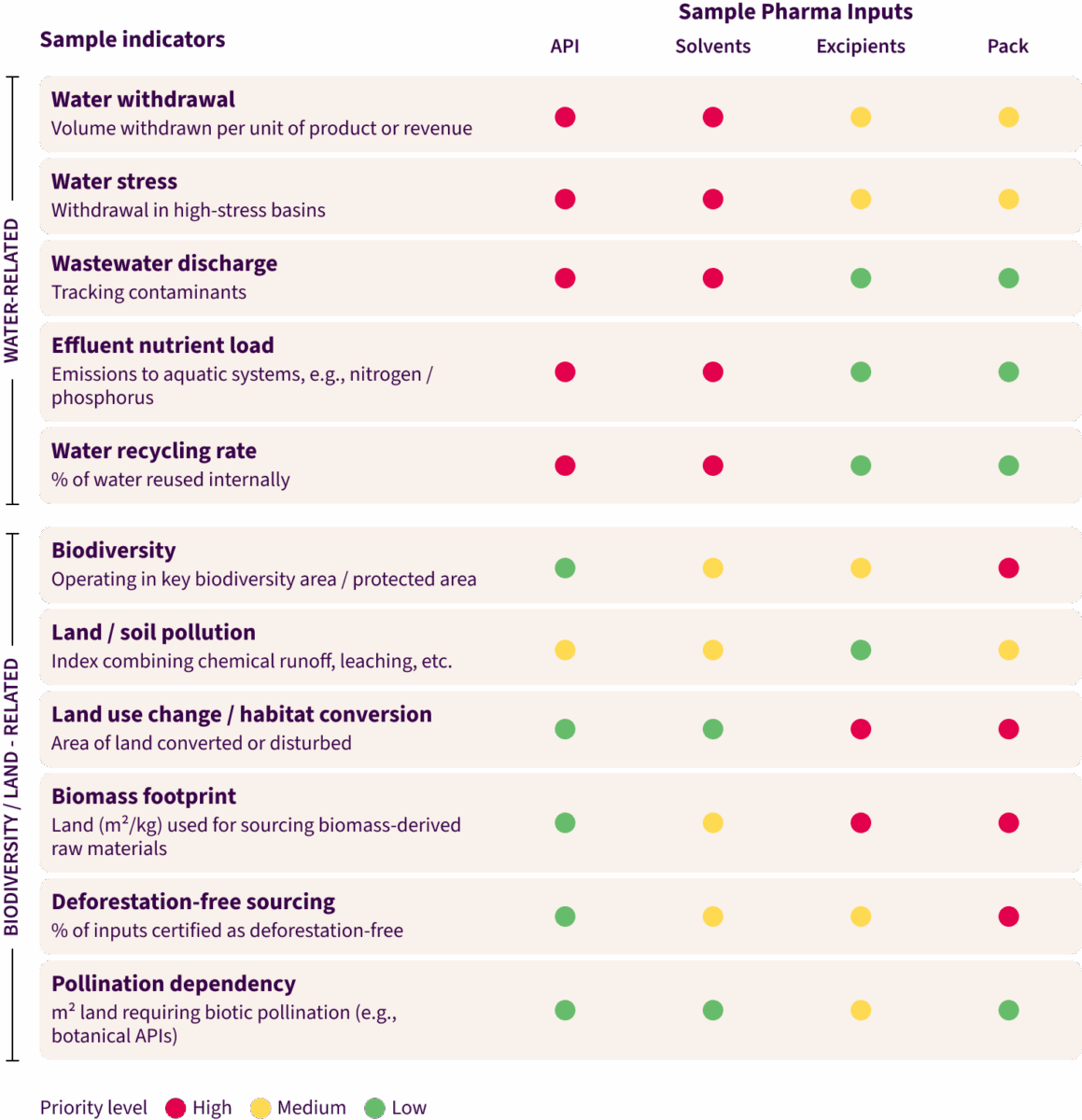

The visual below illustrates how a multi-category approach can prioritize operational focus, highlighting APIs, solvents and bio-inputs as the most urgent categories for action. Packaging and excipients are considered lower priority and can be addressed in a second wave.

Translating those priorities into practice requires embedding nature directly into how key business functions work:

- Drug discovery (R&D): Operationalizing nature in R&D means integrating biodiversity indicators into early-stage research, tracking dependencies on natural compounds, and building partnerships with conservation initiatives to safeguard access to genetic resources. It also means protecting the long-term viability of new medicines: unmanaged pharmaceutical pollution can accelerate antimicrobial resistance, eroding the effective lifespan of new APIs and depreciating R&D investments. Embedding ecotoxicity considerations and supporting basin-level depollution are therefore critical to ensuring that breakthroughs in the lab remain effective in the real world.

- Sourcing & procurement: Pharma’s value chain relies heavily on bio-inputs – plant, animal, or biotech-derived feedstocks that are increasingly vulnerable to drought, soil degradation, and ecosystem decline. Operationalization here means mapping high-risk geographies, embedding water, land-use, and biodiversity criteria into supplier selection, and hardwiring multi-impact requirements (not just carbon) into contracts. Supplier engagement should also evolve beyond carbon-only questionnaires to integrated frameworks that cover water, land and biodiversity, and include joint mitigation plans on issues like water stewardship or deforestation-free sourcing.

- Operations & manufacturing: Pharma is highly water and energy intensive. Embedding nature means setting basin-level water targets, investing in circular water strategies, and ensuring site-level operations are resilient to both climate shocks and ecosystem decline.

By anchoring nature alongside climate in everyday operations, pharma can prevent blind spots, reduce duplication and build resilience across its supply chains.

Why integration matters: efficiency & resilience

Pharma doesn’t need to reinvent the wheel. Most of the systems, data and relationships built for climate can also deliver value for nature. By weaving nature into existing climate efforts, companies can multiply the impact with only marginal additional effort.

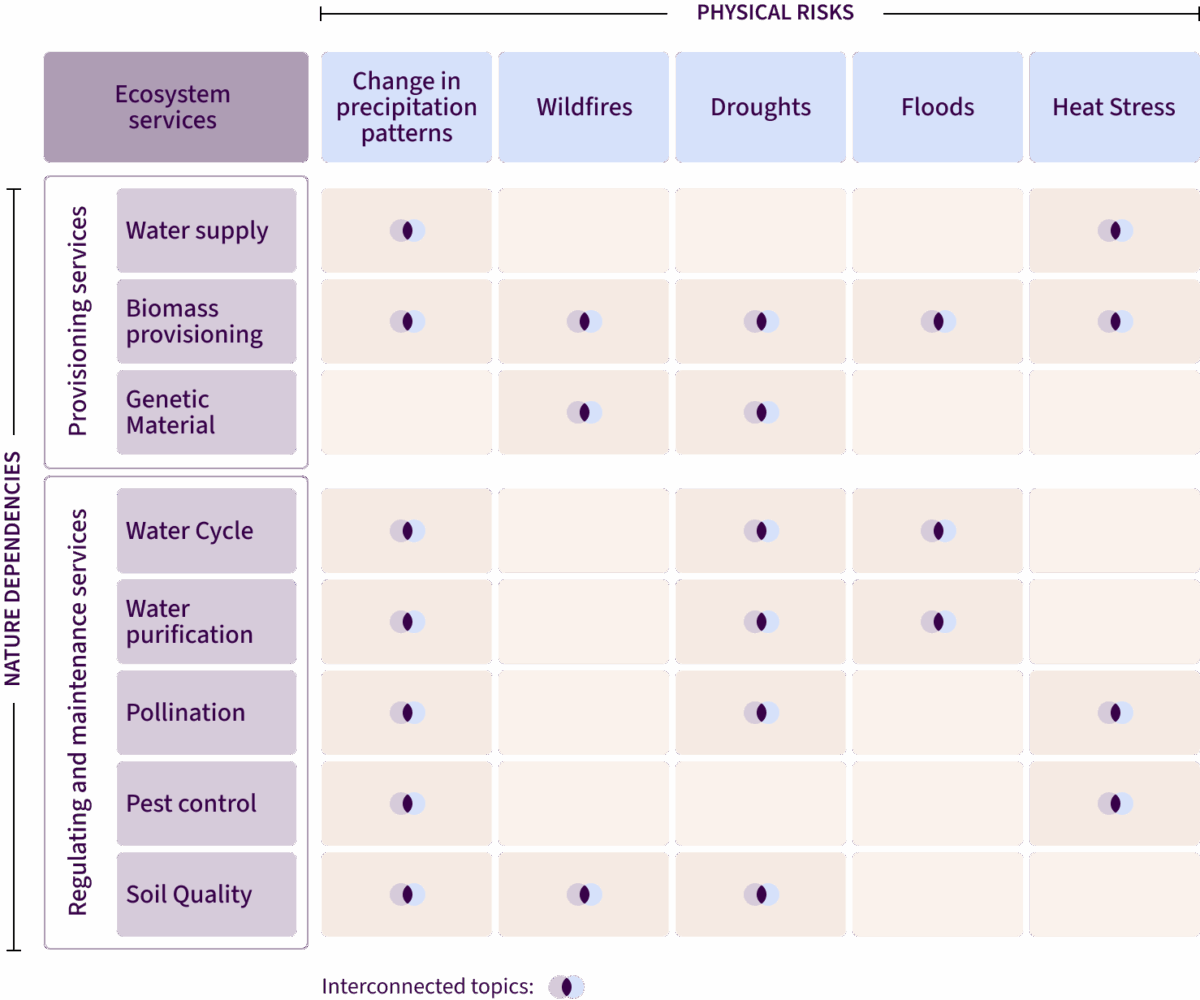

Working on data for one improves the other. As shown in the chart below, efficiency is possible because nature and climate risks are intertwined.

The same life cycle assessment that quantifies carbon can also capture water and land-use impacts. The same supplier questionnaire can gather emissions, biodiversity and deforestation data. Rather than running parallel processes, companies can extend what’s already in place to build one integrated dataset that provides richer insights across both climate and nature – saving time, reducing costs and strengthening supplier relationships.

This is already happening at scale. Through the Sustainable Markets Initiative Health Systems Task Force, companies like AstraZeneca, GSK, Sanofi, Novo Nordisk and Roche are setting joint supplier targets that extend beyond carbon to cover water and waste, with the potential to cut 3.5 million tonnes of CO₂e annually across more than 100 major suppliers. It’s a clear example of how collective action can multiply impact while streamlining effort.

Resilience also improves when climate and nature are tackled together. Both rest on the same financial foundations: they affect supply continuity, compliance costs and access to capital. Major asset managers, including AXA IM, have made clear that biodiversity exposure will influence where they allocate capital. For pharma, this translates into a tangible financial signal: companies that fail to integrate nature alongside climate may face higher financing costs, while those that demonstrate credible, science-based action stand to strengthen investor confidence and preserve access to capital. Mobilizing stakeholders once for both further reduces the likelihood of blind spots – whether it’s water scarcity disrupting Tier 1 suppliers, deforestation regulation reshaping Tier 3 sourcing, or investor scrutiny exposing disclosure gaps.

The overlaps extend to action as well. Many levers serve both climate and nature simultaneously: switching solvents reduces emissions and water toxicity; cutting waste lowers landfill impacts and carbon; circular water strategies reduce ecosystem pressure while improving drought resilience. Companies can also lean on established frameworks to guide integration:

- Extend existing frameworks: TCFD-aligned tools can be expanded into TNFD; CSRD and EUDR already bundle climate and nature into due diligence.

- Broaden supplier engagement: move beyond carbon-only questionnaires toward multi-impact frameworks that capture land, water and biodiversity.

- One leading pharma company, for example, began by integrating climate considerations into procurement for biomaterials; over time, this expanded to include water, land-use and biodiversity, showing how existing climate initiatives can naturally evolve into broader nature strategies.

- Scale operational tools: expand PCF (product carbon footprint), risk mapping and reporting systems into multi-impact assessments.

- Use familiar processes: apply TNFD, SBTN and mitigation hierarchies like ACT-D or AR3T that align with pharma’s existing quality and risk systems.

A single, integrated action plan makes existing work go further – unlocking efficiency, strengthening resilience, and closing critical risk gaps across the value chain.

From siloed corporate strategy to integrated business action

The lesson isn’t unique to pharma. In every sector, climate and nature risks are converging – and siloed strategies can no longer keep pace. Operational examples are emerging across R&D, procurement and manufacturing. But what will define the next phase is leadership: elevating those scattered efforts into a clear agenda that guides the whole sector.

Pharma leaders, here are five priorities for action:

1. R&D: Protect the pipeline

- Track dependencies on natural compounds.

- Screen for ecotoxicity early to avoid regulatory and commercial setbacks.

- Partner with conservation initiatives to secure access to genetic resources.

2. Suppliers: Manage ecosystem risk

- Segment suppliers by water, land-use and biodiversity exposure.

- Embed nature KPIs into scorecards and contracts.

- Collaborate on deforestation-free sourcing and basin-level water stewardship.

3. Sites: Build resilience where you operate

- Set basin-level water targets for key hubs.

- Deploy circular water systems to cut both drought risk and effluent load.

- Monitor and mitigate pharmaceutical residues.

4. Finance: Hardwire nature into decisions

- Integrate nature KPIs into carbon pricing and capital allocation.

- Align with investor expectations (EU Taxonomy, CSRD, TNFD).

- Quantify avoided costs, from wastewater treatment to raw material volatility.

5. Standards: Lead beyond the company

- Join collective platforms (SMI, WBCSD) to co-define metrics.

- Work with regulators to shape Extended Producer Responsibility schemes.

These priorities show where pharma must take the next step; the challenge now is making them part of everyday decisions across labs, supply chains and manufacturing sites.

Quantis continues to support leading pharma companies in operationalizing nature alongside climate. By bringing cross-sector insights, science-based tools, and hands-on implementation support, we help pharma leaders close the gap between commitment and execution.

Quantis is an experienced, full-service partner for your transformational journey. Our strategic advisors are equipped to guide and support you at every point along the way.