In brief:

- Performance and value become essential KPIs for CSOs

- Climate adaptation becomes an unavoidable part of a strong business strategy

- Scope 3 decarbonization becomes a commercial and procurement-driven shift

- Supply chain transparency becomes essential to delivering credible climate progress

- Digitalization and AI become the launch pad for sustainability acceleration

- Climate and nature strategies finally converge to deliver efficiencies

- Sustainability claims continue to face intensifying scrutiny

As the year comes to an end, a new chapter begins.

In 2025, regulatory expectations intensified, supply chains moved to the center of climate delivery, and financial stakeholders increased their focus on environmental exposure and operational resilience. Nature-related risks gained new prominence as droughts, floods and heat disruptions affected assets and supply networks across multiple regions.

Across sectors, we saw a clear shift: sustainability is no longer a parallel workstream; it’s shaping business decisions, investment, innovation and resilience.

The year also brought forward new insights and practical tools that helped companies reinforce their foundations — from more rigorous guidance for environmental claims to digital frameworks, early applications of AI in data analysis and emerging adaptation roadmaps. The result was a more grounded, operational approach to climate and nature action, driven by the need for measurable, credible outcomes.

Here are seven drivers that defined sustainability in 2025 — and what they signal for the year ahead:

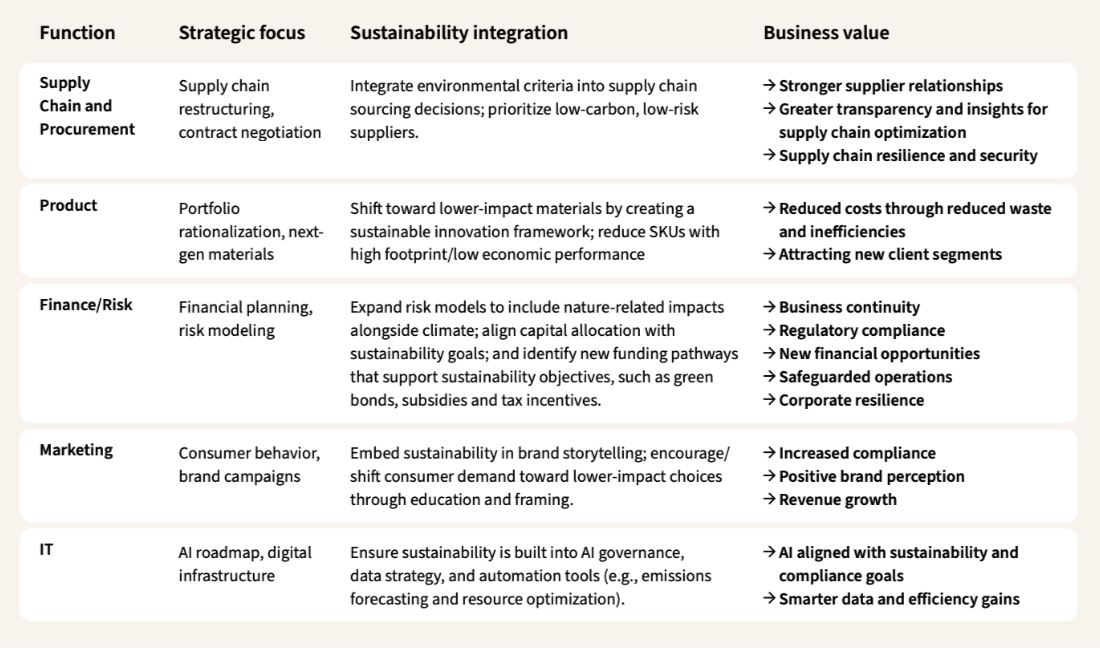

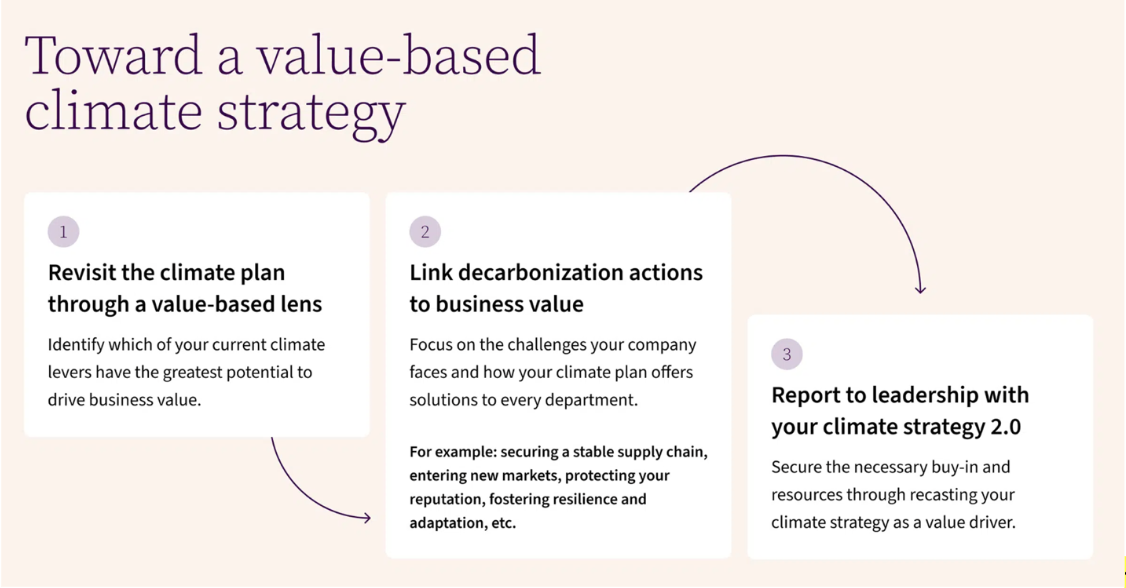

1. Performance and value become essential KPIs for CSOs

The expectations on sustainability leadership continued to rise this year. Leaders were asked to quantify environmental and business benefits, not just champion ambition. Many had to demonstrate how sustainability influences cost control, supply stability, risk mitigation and operational efficiency.

This shift was visible in the kinds of questions leadership teams and boards asked:

- What is the financial exposure of climate-driven disruptions?

- What does the cost of inaction look like for critical materials or markets?

- Which sustainability levers generate efficiency gains or reduced volatility?

- Where do we need new KPIs tied to resilience, nature or supply performance?

Leadership now requires fluency across climate science, procurement, data systems, claims governance and organizational change — ensuring sustainability supports business performance rather than operating alongside it.

Source: A force to lead How Chief Sustainability Officers can claim their relevance, 2025

2026 Outlook: Leaders will continue to focus on equipping procurement, finance, R&D and operations with the capabilities, incentives and data needed to deliver measurable results.

2. Climate adaptation becomes an unavoidable part of a strong business strategy

Physical climate risks intensified across multiple geographies, forcing companies to confront the operational realities of climate exposure. According to analyses this year, weather-related disasters have tripled over 25 years, causing more than $200 billion in damages in 2023. Companies also learned that climate impacts in a 2°C world could drive 5–25% losses in annual EBITDA, depending on sector and geography.

Resilience assessments revealed pressure points across sites and supply chains — and, in some cases, the use of digital and AI-enabled climate models helped teams interpret complex exposure data more quickly. These tools supported decisions on where to prioritize action as companies identified:

- Heat exposure with the potential to reduce labor productivity by up to 50%

- Flood-prone logistics hubs capable of halting regional distribution

- Water-stressed basins threatening ingredient processing volumes

Insights like these prompted investment in cooling systems, water-reuse strategies, site protections and diversified sourcing. Adaptation increasingly informed operational and financial planning.

2026 Outlook: More companies will extend adaptation planning to suppliers and regions, integrating climate-risk considerations into capital allocation and business continuity strategies.

3. Scope 3 decarbonization becomes a commercial and procurement-driven shift

By 2025, the scope 3 conversation shifted from diagnosing hotspots to reshaping how companies work with suppliers. The most meaningful progress came from changes in commercial relationships rather than new target-setting. Companies began building climate requirements into contracts, linking preferred-supplier status or longer-term agreements to environmental performance. Some offered premiums of roughly 5-10% for verified lower-impact materials; others tied business continuity to evidence of improvement, and in some cases, long-standing relationships ended when suppliers failed to match environmental ambitions.

Procurement teams became central to this shift. Specifications, sourcing criteria, and incentive structures started to reflect climate considerations, giving suppliers clearer signals about what matters and how progress will be measured. This moved scope 3 decarbonization from ad-hoc engagement to more structured, partnership-based approaches.

Source: Feeling the heat: How CSOs can lead the climate comeback, 2025

Examples from the year show how this played out:

- A cosmetics company’s procurement team partnered with suppliers to reformulate a product, reducing material use by nearly 65% and glass by ~30%, lowering both emissions and cost.

- A global retailer identified agricultural efficiency improvements that delivered ~20% emissions reductions while cutting operating expenses.

- A food manufacturer found that three climate-sensitive ingredients represented 20% of revenue, prompting focused sourcing strategies and supplier programs.

2026 Outlook: Companies will deepen performance-linked contracts, pursue shared investments with suppliers and concentrate efforts where they hold the strongest commercial influence.

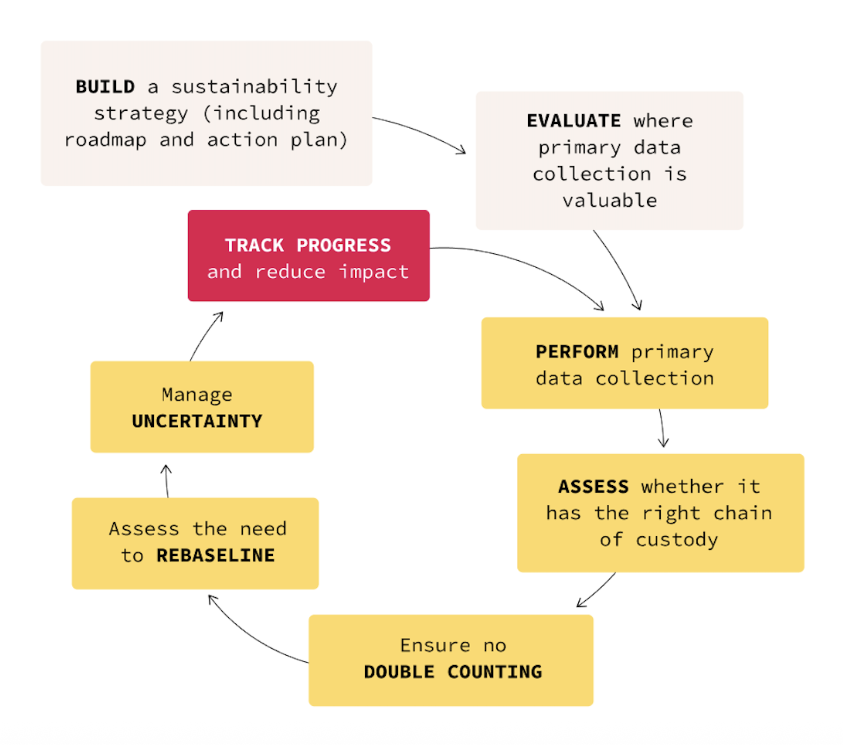

4. Supply chain transparency becomes essential to delivering credible climate progress

In 2025, it became clear that transparency is one of the most critical — and most difficult — requirements for delivering on 2030 climate goals. Most climate and nature impacts occur upstream, but many companies still lacked dependable information about where materials came from, the practices used to produce them or the environmental pressures facing suppliers.

These gaps reduced confidence in reporting and claims, and made it harder for companies to understand where exposure was growing or whether supplier practices were shifting in meaningful ways. Over the past year, some organizations began to strengthen how they gather upstream information, building a clearer view of sourcing regions, production methods and local environmental pressures. This helped teams identify where impacts concentrate, where vulnerabilities — such as water stress or land degradation — required attention and, in some cases, surfaced climate-sensitive commodities or regions they had never assessed before.

Source: Tracking Progress in the Supply Chain, 2025

Transparency didn’t solve the challenge, but it reduced blind spots and strengthened the foundation for climate and nature strategies. For one company, clearer upstream insight cut the gap to climate targets by 50% and lowered mitigation costs by 30%. As 2030 approaches, understanding upstream realities has become essential for credible action and communication.

2026 Outlook: Companies will focus on converting upstream insight into sharper priorities, identifying the categories and regions with the highest exposure. Some may also explore circularity and resource-efficiency strategies to reduce dependency on vulnerable supply streams.

5. Digitalization and AI become the launch pad for sustainability acceleration

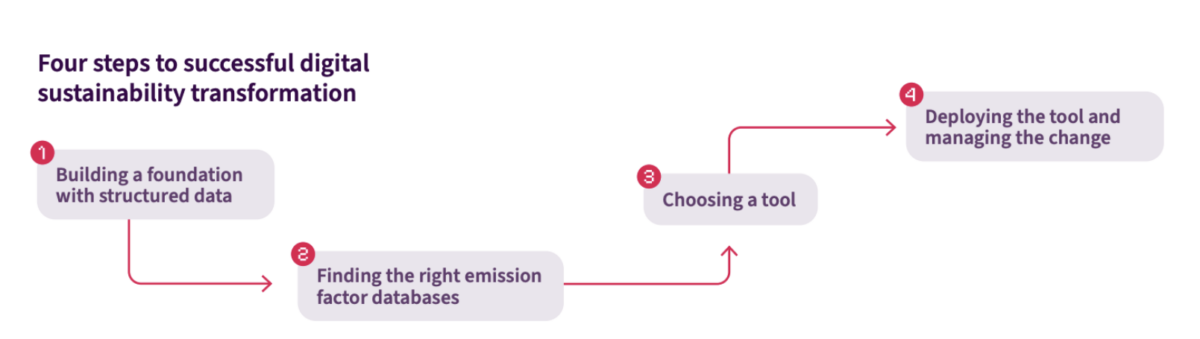

2025 showed that meaningful scope 3 action depends on stronger data foundations. Many companies were still working with manual processes, and only 15–20% of footprint or ESG data flowed automatically. That limited their ability to compare suppliers, track changes or confirm whether interventions were delivering results.

As organizations improved data quality and consistency, digital workflows — and increasingly AI — became more useful. AI supported teams by sorting large datasets, flagging inconsistencies and helping run calculations when supplier information was incomplete. After a merger, one food producer found major inconsistencies in procurement data that had been obscuring footprint trends; once standardized, reporting became faster and more dependable.

Digitalization — supported by responsible use of AI — is becoming the layer that connects footprinting, supplier performance and commercial decisions. Stronger data is helping companies move scope 3 from analysis to action.

Source: Digital done right, 2025

2026 Outlook: Companies will use AI more intentionally to streamline scope 3 calculations, compare suppliers and support scenario analysis. Early applications show efficiencies of up to 30% in corporate reporting and 90% in life cycle analyses (LCAs) and Product Carbon Footprints — but only where strong data foundations are already in place.

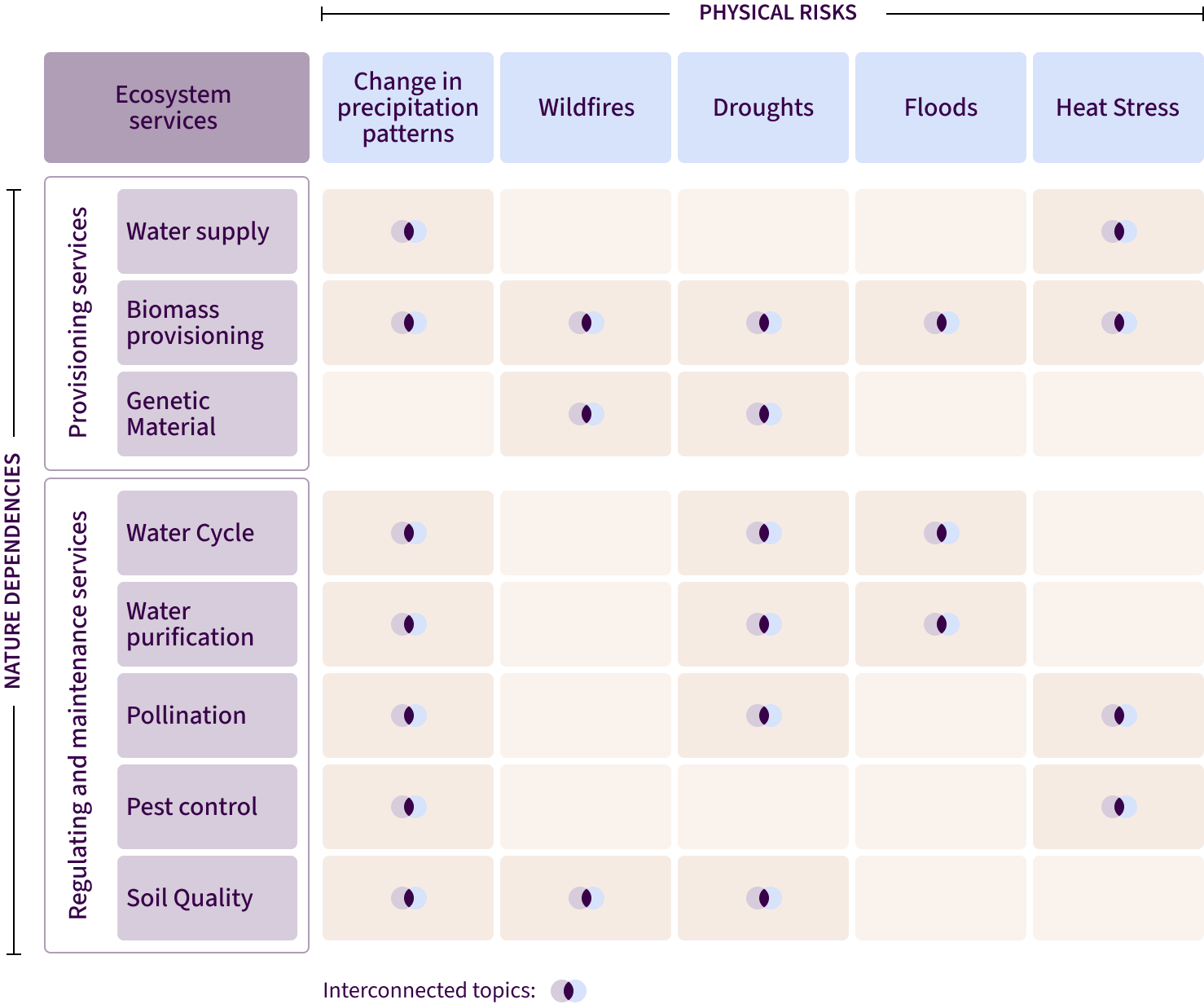

6. Climate and nature strategies finally converge to deliver efficiencies

In 2025, companies began to recognize more fully how climate and nature risks intersect. Water stress, soil degradation, land-use pressure and biodiversity loss shape supply continuity and product quality in many of the same ways that climate impacts do. When ecosystems weaken, exposure to climate volatility grows; when ecosystems are healthy, resilience improves.

As organizations looked deeper into their value chains, they uncovered risks that sit across both climate and nature:

- Declining water availability in basins where production depends on stable flows

- Soil degradation that reduces yields and increases drought sensitivity

- Pollinator loss in regions tied to high-value crops

- Deforestation exposure linked to ingredients with significant climate footprints

Companies responded with actions that strengthened both climate and nature outcomes, such as:

- Regenerative practices to improve soil structure and water retention

- Watershed investments to stabilize supply in water-stressed regions

- Stronger sourcing criteria that incorporated land-use and biodiversity considerations

Pharma offers a powerful illustration. Roughly 80% of medicines originate from natural sources, making the sector heavily dependent on ecosystems. Biodiversity loss, water stress and climate-driven crop failures have already influenced the availability of key compounds, while impacts such as water use and pharmaceutical residues are contributing to regulatory and cost pressure.

Source: Pharma example, Quantis analysis, 2025

Across industries, companies moved toward integrated approaches that address climate and nature together, reducing duplication and revealing risks siloed strategies often miss.

2026 Outlook: Organizations will extend climate programs to include nature-related data and KPIs, using existing systems to build more complete and resilient approaches.

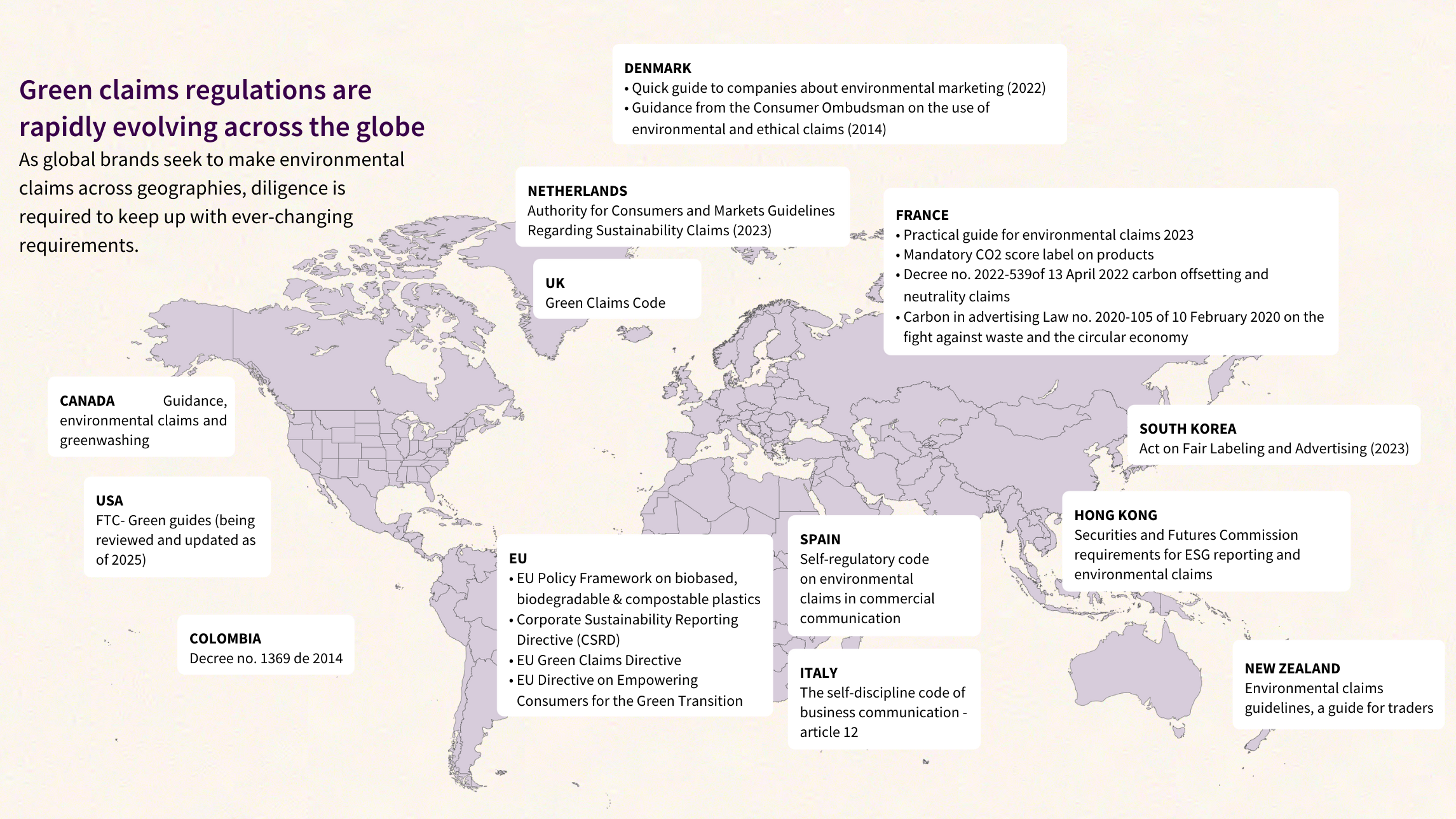

7. Sustainability claims continue to face intensifying scrutiny

In 2025, environmental claims came under sharper scrutiny. Regulators emphasized that claims must be accurate and framed in ways that reflect the full product footprint. This renewed attention to issues such as incomplete life cycle boundaries, reductions smaller than the uncertainty range and statements that focus on a minor part of the footprint while implying broader impact.

Source: Guidelines For Credible, Science-driven Environmental Footprint Claims, 2025

Based primarily on the United Nations (UN) Guidelines for Credible Sustainability Communication, the ISO 14020 family from The International Organization for Standardization (ISO) and the EU Product Environmental Footprint (PEF) framework, credible claims should be specific, measurable, relevant, understandable and accessible.

A common challenge is relevance: highlighting improvements in a component or life cycle stage that represents only a small share of total impact. The guidance illustrates this with packaging. If packaging accounts for 10% of a product’s footprint but its emissions are reduced by 50%, both values should be communicated to avoid overstating the benefit.

A clearer formulation might read: “By changing the material of our packaging from A to B, we are reducing the climate impact of our product by 5% and the impact of the packaging itself by 50%.”

2026 Outlook: Claims governance will extend beyond climate to include nature, water and circularity — making relevance, clarity and methodological consistency even more important.

Looking ahead: implementation and acceleration become the priority

The coming year will bring its share of pressure, but also possibility. The foundations are in place: stronger data, clearer expectations, deeper supply-chain insight, and more robust governance. The next step is about acceleration. It’s time to turn the groundwork into consistent, measurable results.

Acceleration will depend on:

- Using transparency to sharpen priorities

- Embedding scope 3 levers into procurement, R&D, finance and product teams

- Deploying digital and AI tools to speed decision cycles

- Integrating claims governance early

- Making adaptation a continuous capability

- Aligning sourcing and product strategies with both climate and nature realities

Companies that act now — even when progress feels incremental — will move the needle forward. And those that treat sustainability as a strategic driver of business performance and resilience, embedded in everyday decisions and scaled across teams, will be best positioned to build momentum in 2026.