All listed and large private companies that are active in the EU will have to implement the CSRD by 2029.

Environmental, Social and Governance (ESG) reporting is instrumental in showcasing a company’s commitment to sustainability. And in today’s business landscape, it’s a strategic imperative.

Yet, in most markets, regulations that enforce standardized metrics and methodologies are few and far between, leading to inconsistent data that hampers comparability across companies and sectors. Without clear reporting standards, companies are free to emphasize their strengths and downplay their weaknesses. The result? Under-informed investors and accusations of greenwashing, neither of which help most companies in the long run.

The European Union is taking the lead to address these shortcomings and codify a standard that can be uniformly applied so that companies’ sustainability efforts can be fairly compared and those who count ESG as investment criteria can be duly informed. On July 31, 2023, the European Commission adopted the European Sustainability Reporting Standards (ESRS) to be used by all companies subject to the Corporate Sustainability Reporting Directive (CSRD).

The published delegated act adopts the final version of the ESRS, and is supplemented by Annexes I and II, which define sustainability reporting standards that companies must use in accordance with the CSRD.

What is the CSRD?

As part of the European Green Deal, the CSRD aims to enhance sustainability reporting and transparency by obligating companies to use common standards, helping make it easier for investors, civil society organizations, consumers and other stakeholders to evaluate companies’ sustainability performance. The directive requires all large companies and listed companies — with the exception of listed micro-enterprises — to disclose information on the risks and opportunities for their business arising from social and environmental issues and on the impact of their activities on people and the environment.

The information needs to be reported following the ESRS, which have been adopted by the Commission through delegated acts that define the content and, if applicable, the structure for presenting the information. The ESRS delegated act will be passed along to the EU Parliament and Council for a two-month scrutiny period, with implementation set to begin for some companies for the 2024 fiscal year.

The CSRD replaces and builds on the existing Non-Financial Reporting Directive (NFRD) to strengthen and streamline sustainability reporting requirements. The NFRD lacked crucial details for investors and stakeholders, making it challenging to compare company reports and creating uncertainty about their reliability and actionability. For the green investment market to be credible, investors need reliable information about companies’ environmental impacts (and their strategies for reducing these impacts in the future) to appropriately direct funds toward sustainability-linked initiatives.

The CSRD’s expanded scope of the NFRD intends to reduce corporate greenwashing, as well as implement full and harmonized disclosure of ESG topics. The CSRD also puts sustainability reporting on the same level as financial reporting, requiring that information about sustainability risks are more publically available.

What does the CSRD mandate?

The main objective of the CSRD is to provide relevant stakeholders, including investors, consumers and policymakers, with comparable non-financial information to assess company risks around climate change and other ESG issues. Since companies will have to report under one common framework, stakeholders will have access to clearer, comparable and more reliable information.

Companies will have to start by disclosing an overview of their legal and policy structure before diving into their sustainability journey. However, certain ESG topics are more relevant to some companies and sectors more than others. When determining which ESG topics companies will need to report on, the ESRS takes a “double materiality” perspective. Reports should also include corporate strategies to mitigate and adapt to ESG risks, depending on the results of their double materiality assessment.

The reported information should cover short-term, medium-term, and long-term perspectives, as appropriate. The report must be integrated within a company’s management report, rather than published as a separate annual report, and it must be in a standardized digital format so it can be easily compared with other companies.’

What is Double Materiality?

The CSRD emphasizes double materiality as a key step for compliance and requires companies to perform a double materiality assessment, which considers both a company’s material impact on society and the environment and how a company is materially impacted by ESG issues.

Depending on the results of a company’s materiality assessment, reporting under the CSRD will need to cover a range of environmental topics beyond climate, such as pollution, water, biodiversity and natural resource use, as well as social and governance topics.

Key Terms

Double Materiality → An approach that includes both how sustainability issues create financial risks and opportunities for a company (financial materiality) and a company’s own impacts on people and the environment (impact materiality).

Financial Materiality → A sustainability issue has an impact on or could reasonably be expected to have an impact on (positive or negative) a company’s business model, cash flow, revenue or enterprise value.

Impact Materiality → A business activity has an actual or potential impact (positive or negative) on people or the environment over the short-, medium- or long-term.

Mitigation and adaptation

In addition to double materiality, companies must disclose their strategies to mitigate and adapt to sustainability-related risks. Companies will need to outline their business model and strategy, a timeline of sustainability initiatives, governance, impacts, risks and KPIs. This information will enable investors and other relevant stakeholders to track the progress of corporate sustainability initiatives.

Reporting under the CSRD

The CSRD requires sustainability information to be subject to assurance. Companies’ statutory auditors will be required to carry out sustainability reporting assurance in partnership with another auditor or an independent assurance provider. Auditors’ reports must be integrated into the company report and align with other global standard-setting initiatives, such as the Sustainable Finance Disclosure Regulation (SFDR) and EU Taxonomy Regulation.

Information on how or when the EU Commission will impose sanctions for businesses that fail to comply with the CSRD is not yet available. However, we expect them to be significant.

There are 12 reporting standards covering the full range of sustainability issues, in line with the European Financial Reporting Advisory Group’s (EFRAG) proposal:

| Group | Number | Subject |

| Cross-cutting | ESRS 1 | General Requirements |

| Cross-cutting | ESRS 2 | General Disclosures |

| Environment | ESRS E1 | Climate |

| Environment | ESRS E2 | Pollution |

| Environment | ESRS E3 | Water and marine resources |

| Environment | ESRS E4 | Biodiversity and ecosystems |

| Environment | ESRS E5 | Resource use and circular economy |

| Social | ESRS S1 | Own workforce |

| Social | ESRS S2 | Workers in the value chain |

| Social | ESRS S3 | Affected communities |

| Social | ESRS S4 | Consumers and end users |

| Governance | ESRS G1 | Business conduct |

ESRS 1 (“General Requirements”) sets general principles to be applied when reporting and doesn’t set specific disclosure requirements. ESRS 2 (“General Disclosures”) specifies essential information to disclose, irrespective of the sustainability matter being considered. ESRS 2 is also mandatory for all companies under the CSRD.

All the other standards and individual disclosure requirements — including the data points within them — are subject to a materiality assessment. Companies will only need to report relevant information and may omit information that isn’t determined to be material to its business model and activities.

Which companies will be impacted by CSRD, and when?

CSRD will apply to EU-based public companies, alongside all EU-based private organisations considered “large”. This means that the have 250+ employees, €50m+ annual revenues and/or €25m+ balance sheet.

There are around 50,000 listed companies that will eventually have to comply with the CSRD, although there are some exemptions to the initial implementation. All listed companies that are active in the EU will have to implement the CSRD by 2029.

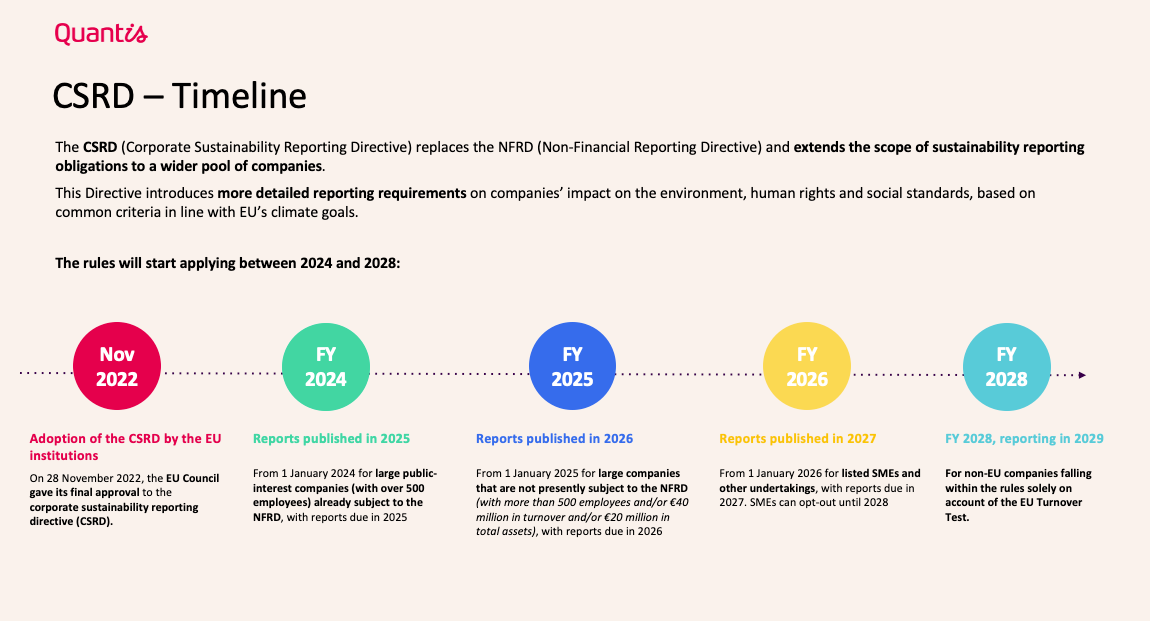

Companies will have to start reporting under ESRS according to the following timetable:

FY 2024 → Companies previously subject to the NFRD (large listed companies, large banks and large insurance undertakings that have more than 500 employees), as well as large non-EU listed companies with more than 500 employees will need to report on the 2024 fiscal year, with the first sustainability statement published in 2025.

FY 2025 → Other large companies, including other large non-EU listed companies, will need to report on the 2025 fiscal year, with the first sustainability statement published in 2026.

FY 2026 → Listed SMEs, including non-EU-listed SMEs, will need to report on the 2026 fiscal year, with the first sustainability statements published in 2027. However, listed SMEs may decide to opt out of the reporting requirements for a further two years. The last possible date for a listed SME to start reporting is the 2028 fiscal year, with the first sustainability statement published in 2029.

FY 2028 → In addition, non-EU companies that generate over EUR 150 million per year in the EU and that have, in the EU, one of the following

(a) a branch with a turnover exceeding €40 million

(b) a subsidiary that is a large company

(c) a listed SME

will have to report on the sustainability impacts at the group level of that non-EU company as from the 2028 fiscal year, with a first sustainability statement published in 2029. Separate standards will be adopted specifically for this case.

Beyond CSRD

While the CSRD has been adopted by the European Commission, it will have global implications. Any listed company that is active in the EU, even if they are headquarted outside of the EU, will have to comply under CSRD, which hints at the start of globalizing sustainability reporting.

Many other countries have plans to create regulations in alignment with the CSRD or match its ambitions. For example, the UK is planning to create UK Sustainability Disclosure Standards (SDS) for corporate reporting on sustainability-related risks, setting the foundation for future legislation around sustainability topics. Switzerland has also announced plans to discuss alignment with the CSRD. The ultimate goal is to have a standardized global framework for sustainability reporting.

What can businesses do to prepare?

There are five steps that every company should take to prepare for CSRD:

Step 1: Know if and when you must comply. Before making any plans, you need to know whether or not your company falls under the CSRD’s purview. If you do, it’s important to know where you fall in order to accurately determine your timeline.

Step 2: Address your corporate sustainability governance or the roles and responsibilities regarding CSRD reporting and disclosure within your organization. Who is responsible? Who needs to be involved across the value chain? What kind of training and engagement is needed?

Step 3: Start addressing double materiality and engaging your relevant stakeholders. A materiality assessment can capture multiple perspectives on ESG and provide important information to set a course and determine where future investment may be required. CSRD double materiality (financial impact and environmental and social impacts), results in a matrix clustering of ESG topics, which companies can use to either monitor for compliance or enable sustainable transformation.

Step 4: Look for gaps in your data collection and data management systems. What are you currently reporting? What are you not reporting? Compare your current sustainability framework (if you have one) with the requirements of the CSRD and ESRS. The ESRS is a framework that is based on other frameworks — GRI, TCFD, EU Taxonomy, etc. — so if your company is already conducting non-financial reporting with these frameworks, performing a gap analysis will be easier.

Step 5: Identify potential financial effects, transition risks and climate-related opportunities. For example, while climate change disclosure isn’t mandatory, it’s strongly recommended. If a company decides that climate change isn’t a material topic and doesn’t report on it, it must include a detailed explanation outlining why, based on the materiality assessment. Since climate change has wide-ranging, systemic impacts across the economy, companies may need to report Scope 1, 2 and 3 greenhouse gas (GHG) emissions and reduction targets. If you don’t currently have reduction targets, you’ll have to disclose when those plans will be made.

It’s essential not to underestimate the work that will need to be done to comply with the ESRS and start preparing now to set your company up for success with investors, consumers and relevant regulatory frameworks.

Need help navigating the CSRD or any of the five environmental standards? Contact our team!

Latest resources

4 nature-related risks facing the cosmetics industry

Quantis' Emmanuel Hembert outlines the nature risks facing the future of the cosmetics industry.

How digitalization is unlocking a new era of sustainability in fashion...

While digitalization alone doesn’t guarantee perfect accuracy, it plays a crucial role in many ways like fostering more meaningful supplier engagement, boosting data quality and...

Why an environmental sustainability strategy without nature is incomplete

Businesses have an essential role to play in reversing the trend of nature loss — and a lot to lose from inaction.