In an environmentally conscious era, the watch and jewelry industry must choose between business-as-usual and future-proofing its business models.

In an environmentally conscious era, the watch and jewelry industry must choose between business-as-usual and future-proofing its business models. Anne-Sophie Verquère, Principal Strategist serving the luxury watch industry at Quantis, and Sabine Loetscher, Quantis Switzerland’s Fashion + Sporting Goods Sector Lead, answer a few questions about sustainability issues, risks and challenges facing the watches and jewelry sector.

How sustainable is the watches and jewelry industry?

Sabine: Sustainability in watches and jewelry has gained traction in recent years. Companies are increasingly recognizing the need to integrate sustainable practices into their operations; however, while engagement is on the rise, the pace of progress falls short of what’s necessary to address the pressing environmental concerns associated with the industry. A particular concern stems from the mining process for the precious stones and other raw materials that are used to craft these items. The WWF’s 2023 Watch and Jewelry report gave a sustainability rating to the top 21 luxury watch and jewelry brands, and only 7 brands broke the upper half of the rating system.

Anne-Sophie: There’s also been growing awareness among consumers about the environmental and social impacts of their purchases. This shift in consumer behavior is propelling companies to rethink their approaches to sustainability, especially as younger generations begin to earn more and increase their collective purchasing power. Millennials and Gen Zers, as well as urbanites, are generally more willing to pay for products that have net-zero production emissions. The companies that tackle their environmental impacts today are more likely to earn – and maintain – the trust of these consumers.

What are the environmental impacts of mining in the watches and jewelry industry?

Anne-Sophie: The mining activities associated with the watches and jewelry industry exert significant pressure on the environment spanning multiple topics. From deforestation to soil degradation, these operations leave a profound footprint. Forests are cleared to make way for mining sites, leading to biodiversity loss. Soil quality suffers due to the disturbance caused by mining activities, which also harms local ecosystems and agricultural productivity.

Sabine: To add on to that, mining operations disrupt the natural water cycle, leading to water scarcity and contamination. The use of toxic chemicals in mining processes further exacerbates these environmental challenges, posing risks to aquatic life and human health. Environmental and social issues are deeply interconnected, with the loss of biodiversity and the degradation of water sources profoundly affecting human rights, including livelihoods, land rights and access to clean water in mining regions.

When working with the watches and jewelry industry on sustainability, what are the biggest challenges you typically encounter?

Anne-Sophie: The sector is very traditional but is gradually catching up with ‘modern’ expectations of sustainability. Recently, there’s been increasing awareness, and the major players in the sector have launched initiatives to accelerate their commitments, such as the Watches and Jewelry Initiative 2030. Even though they’re not directly involved in metal extraction activities for the most part, watch and jewelry brands can still have tremendous influence and lead the charge for fairer, more transparent and responsible value chains, be they for gold, silver or precious stones. The main challenge remains addressing the climate crisis and nature loss in mining regions. Mining is highly energy-intensive, accounting for up to 11% of global energy consumption.

Sabine: Sustainability requires a complete business model transformation and shakes up the culture of established companies. Exploring and refining new business models demands dedicated involvement and seamless teamwork across the C-suite, strategy, design, marketing, sustainability, operations and finance teams. Brands have a social and environmental responsibility along the value chain from the mining sites from which they obtain their supplies to their customers. The sector also has a duty to set an example because it has the means to finance its own transition, with brands having strong positioning and comfortable margins.

What risks does the industry face if it fails to prioritize sustainability?

Anne-Sophie: Failing to prioritize sustainability poses multifaceted challenges for watches and jewelry companies. Firstly, there’s a reputational risk; in an era where consumers increasingly value transparency and ethical practices, companies that neglect sustainability may face backlash, damaging their brand image and market standing. While watch and jewelry consumers are not yet calling for sustainability at the same scale as in consumer goods industries, the industry can play an inspirational role in proactively championing sustainability. The industry has already faced scrutiny for the social impact of watches and jewelry, the call for environmental sustainability will only grow as consumers connect unsustainable mining practices with the brands they purchase from.

Sabine: Companies need to consider the supply chain risk, especially the potential disruptions in mining regions where the consequences of the climate crisis are already visible. There are also recent regulations that demand transparency and non-financial reporting around sustainability, such as the recent (CSRD). A lack of traceability within supply chains makes it difficult to ensure the sustainable sourcing of materials, exposing companies to these potential operational and regulatory risks. Companies can start mitigating these risks by conducting supplier audits, establishing best practices or standards for them to abide by, and investing in technologies that can provide material tracking information.

What recommendations would you offer to watches and jewelry companies to enhance their sustainability efforts?

Sabine: To drive meaningful, positive change, companies need to start by understanding their nature impacts and dependencies through a comprehensive footprint of their operations. This can help identify hotspots for improvement and inform targeted sustainability strategies. From there, nature dependencies can be tracked and analyzed to increase transparency along the value chain and inform business decision-makers about the best next steps.

Anne-Sophie: Effective communication, both internal and external, is key to fostering a culture of sustainability across the industry. Companies should engage their stakeholders, including suppliers, employees and consumers, in open and honest dialogue about their sustainability initiatives. With consumers, companies can harness direct-to-consumer (D2C) retail methods, which allow them direct access to their target markets to clarify their sustainability initiatives and progress.

While the industry may prefer to remain discrete and limit sectorial initiatives, sustainability challenges cannot be tackled alone. By communicating authentically about their commitments and progress, companies can inspire broader adoption of sustainable practices within the industry. We’ve started to see more willingness for collaboration, especially on topics like footprint methodologies and supplier engagement. This is a good sign.

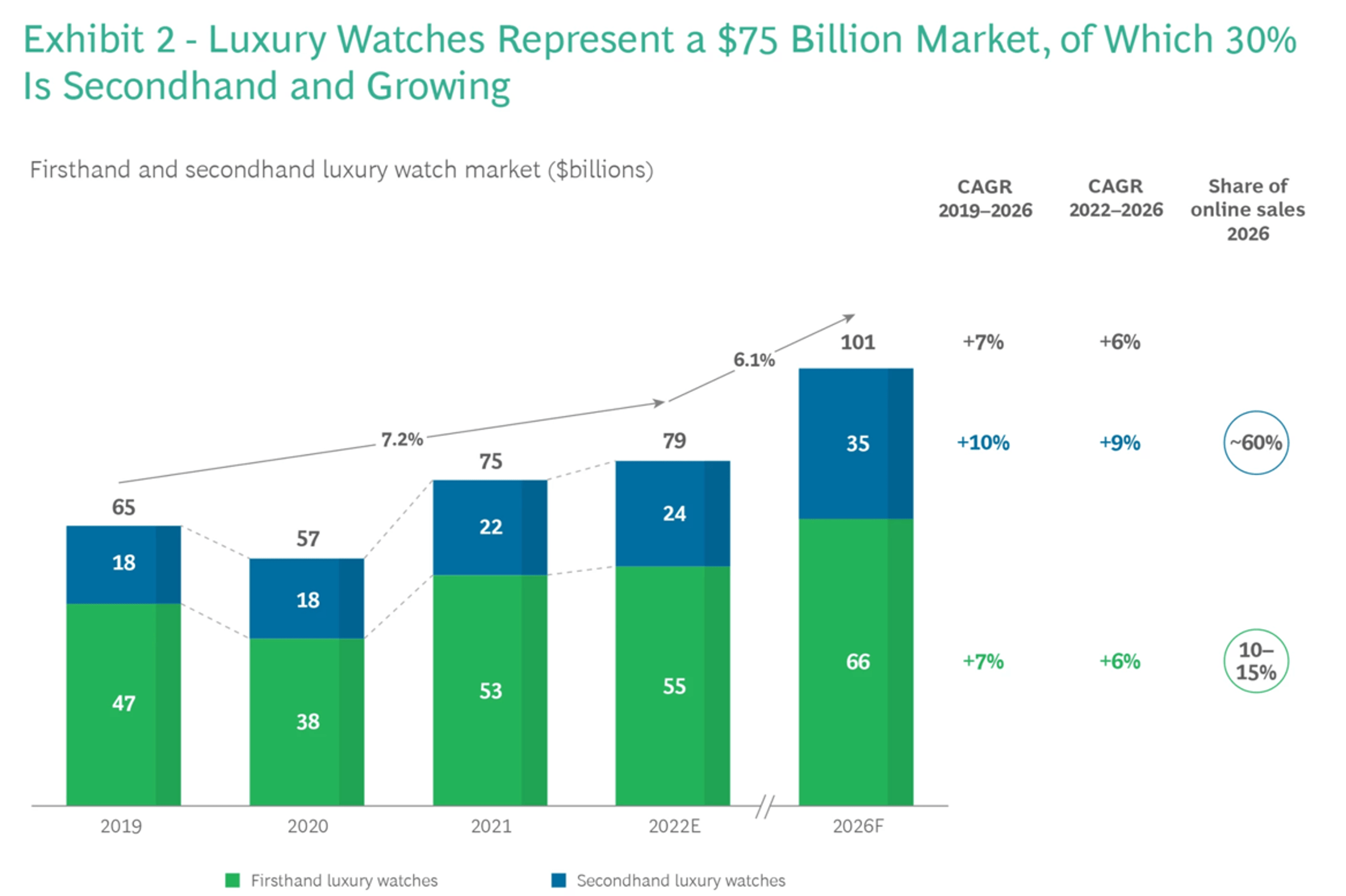

Sabine: I’d also recommend that brands embrace ecodesign principles and promote circularity with their materials. Using recycled materials and exploring opportunities for product recycling and refurbishment could drive down impacts. BCG analysis predicted secondhand luxury watches to make up 35% of the market by 2026. In fact, some watch models increase in value on the secondhand market since brands typically only release a limited number. Often consumers are more willing to pay a premium on the secondhand market to obtain rare, collectible products.

Latest resources

4 nature-related risks facing the cosmetics industry

Quantis' Emmanuel Hembert outlines the nature risks facing the future of the cosmetics industry.

How digitalization is unlocking a new era of sustainability in fashion...

While digitalization alone doesn’t guarantee perfect accuracy, it plays a crucial role in many ways like fostering more meaningful supplier engagement, boosting data quality and...

Why an environmental sustainability strategy without nature is incomplete

Businesses have an essential role to play in reversing the trend of nature loss — and a lot to lose from inaction.